LEADERSHIP

The coming inauguration of a new government in Nigeria has brought about a significant surge in rents and property values across the country, particularly in the highbrow areas of the Federal Capital Territory (FCT) and Lagos.

Ahead of the setting up of a new administration, there will be movement of new legislators, friends of legislators, and families of political office holders into the FCT. The influx of the new officials has raised the demand for high-end housing, leading to a sharp increase in property values.

As of today, in the Central Business District in Abuja, the price of a two-bedroom apartment that previously cost N4 million has risen to N5.5million.

According to reports, the rent in some locations in the FCT has increased by over 35 per cent, despite the economic challenges facing the citizens of the country.

This increase is more pronounced in choice locations, where new members-elect of the 10th House of Representatives are relocating with their family members to commence their legislative duties.

The areas most affected by the rent surge are Wuse II, Maitama district, Asokoro district, Aso Drive, Wuye, Katampe Extension, Wuse 1, 2, 3, 4, and 5, which are likely to accommodate new National Assembly lawmakers when plenary resumes.

Rent for a four-bedroom duplex now goes for N10 million to N12 million in Asokoro and Maitama; the same goes for Wuse ll. Meanwhile, the rent for a four-bedroom duplex in the Wuse axis ranges from N7 million to N10 million, depending on the location. These were areas where a four-bedroom duplex previously cost between N4 million and N6 million.

Some property experts have, however, argued that rents in Abuja and its environs have increased by more than 35 percent, primarily due to the high cost of building materials and the process of acquiring land.

They also admitted that the transition period, which sees members-elect, political appointees and aides move to Abuja, may have contributed to the increased demand for accommodation and properties.

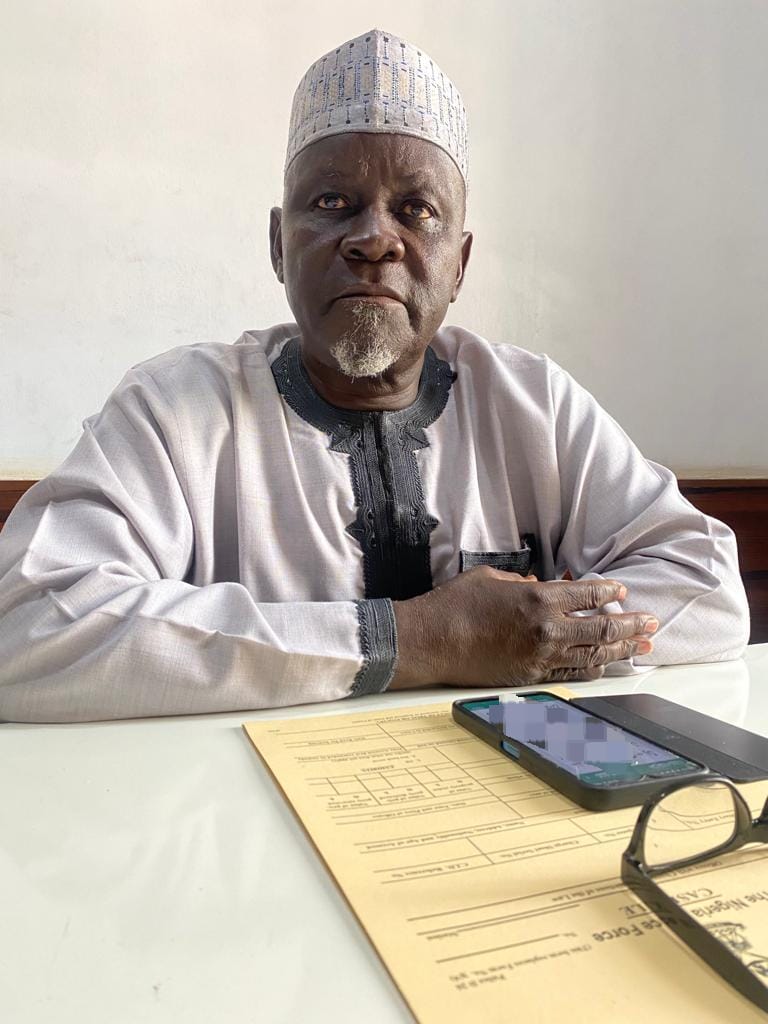

The former chairman of the Abuja chapter of the Nigerian Institution of Estate Surveyors & Valuers (NIESV), Adamu Kazim, explained that rent is a product of income from real estate investment.

The rewards for capital are interest, and the rewards for land are rent, just as the rewards for entrepreneurship are profit. Therefore, in the context of real estate and housing, rent is determined by the supply of available properties,” he added.

The increase in rent is not unexpected given the usual demand for high-end housing in these areas. However, the transition to a new government has further amplified the situation, leading to a surge in rents and property values.

Estate developers, landlords, and agents are experiencing a significant increase in business as new lawmakers and political appointees scramble for accommodation.

The surge in property values is proving to be a boon for estate developers, landlords, and property agents, who are cashing in on the high demand for housing. They are reporting a significant increase in business, with many properties being snapped up as soon as they are listed.

However, the situation is becoming increasingly challenging for those who cannot afford the high prices, and they are being forced to settle for less expensive areas, which are becoming increasingly crowded, or to share accommodation with others.

Some tenants have expressed their struggles to pay their annual rent due to the recent increase, claiming that landlords are increasing rent at their own discretion without considering the tenants’ circumstances.

A businessman, Yusuf Abdullahi, has expressed frustration over the situation, saying he had to relocate his family to an FCT suburb in Nasarawa State due to the increase in rent.

Abdullahi, who is now a landlord in Nasarawa State, explained that the escalating cost of living, including the high cost of energy and transportation, in addition to the growing unemployment rate, had made it challenging for residents to cope with the steep rise in rent prices.

Idris Abdullahi, an estate agent interviewed by LEADERSHIP, said the rent for a duplex in highbrow areas such as Asokoro district now ranges between N10 million and N14 million, depending on the region within Asokoro, as opposed to the previous range of N8 million to N12 million.

A manager at Flourish Estate Limited, Adewale Isaac, cited costs of land and building materials as major factors responsible for the recent rent hike.

He noted that building a house had become more challenging, and by the time construction was finished, the costs would have increased significantly.

According to Isaac, the agents involved in property deals have also raised prices.

“I was recently billed N1.9 million for a two-bedroom flat around Durumi, behind Adisa Estate. I was displeased with the price, because I felt it was too high for the location.

“In Abuja, today, the cost of renting a self-contained room has also significantly increased – from N150,000 to N180,000 last year to around N350,000 in town, Isaac said, explaining that the cost of building materials is consistently rising, making it more difficult for people to construct new houses.

“From a professional perspective, I can say that the landlords and their agents are not increasing rent arbitrarily or out of the desire to exploit tenants. The increase in rent is triggered by a lot of factors that are all there for all to grasp.

“Firstly, the insecurity being experienced across the nation has caused an increase in demand for houses in and around Abuja because people fleeing the violence in states in the North East, North West, some parts of North Central and South East are moving to Abuja where they think it is safe.

The situation is not very different in Lagos, where landlords in areas like Ikoyi, Victoria Island, and Lekki have increased rents by at least 30 percent.

Most affected by the rental surge and hike in rent value are mid to low-income areas where vacancy rates had been at a record low within the past five years.

The neighbourhoods in mainland Lagos with high demand pressure and low vacancy rates include Yaba, Surulere and Magodo.

Other locations, especially the high-density residential segments within the hinterlands in Lagos, have also witnessed almost double in the last three years.

Property consultant and managing director, JJ&J, Mr. Ezekiel Oke, explained that the Nigerian economy is potentially thriving on an import-based economy, and this has further weakened the value of the Naira to rebound the economy.

Ezekiel noted that, like several other sectors of the Nigerian economy, the real estate space has had its fair share of economic challenges erupting from the continued devaluation of the Naira.

“Real estate developers, in most cases, rely on the dollar to perform several integral functions, and the volatile foreign exchange rates could only mean one thing for them.

“Inflation and the free fall of the naira against the Dollar is another factor that has impacted negatively on the cost of rent in Abuja and the country generally. Most of the building materials are imported and this has greatly impacted rent, especially in the high-end niche of the property market,” he said.

The immediate past president, International Real Estate Federation, (FIABCI) Nigeria, Chief Kola Akomolede, corroborated that rents had increased across board in the major cities, particularly in Lagos, due to inflation derived from devaluation of the naira.

Former Redan auditor and managing director of Roccio Carrillo Property Management, Emmanuel Oyelowo said naira depreciation is also accompanied by skyrocketing prices of construction materials, which means that the prices of commercial and residential real estate will have to be rescaled upwards regularly to reflect the changing realities.

“A developer could potentially be at a loss if a property is sold off at the wrong time,” he said.

Meanwhile, the managing director and chief executive officer of Crystal Properties, Olatunde Oloyede, has urged the government to tackle the hike in the cost of building materials as a panacea to providing low cost housing in the built industry across Nigeria.

On the flip side, experts said, another factor pushing up Inflation in the housing sector is the fact that price hikes are strongly determined by rising construction cost, adding that high cost of funds, as reflected in the exchange rate crisis and high-energy cost, were equally a disincentive.

There are growing fears among developers and property managers that there may even be harsher times ahead for the real estate market, while subscribers may need to brace up for future shocks.

The yearly core inflation rate accelerated for the 10th straight month to a 16-year high of 19.2 per cent in January, up from 18.5 per cent in the prior month. On a monthly basis, consumer prices surged by 1.87 per cent, the most in almost 16 years, after a 1.71 per cent increase in the previous month.

A past chairman, Faculty of Estate Agency and Marketing, Nigerian Institution of Estate Surveyors and Valuers (NIESV), Sam Eboigbe, said since the global economic meltdown imparted prices of goods and services, the property market will not enjoy immunity from the effects.