PUNCH

•Borrowing from CBN illegal, suspicious, say NECA, LCCI, economists

•N22.7tn extra-budgetary spending to raise public debts to N69tn

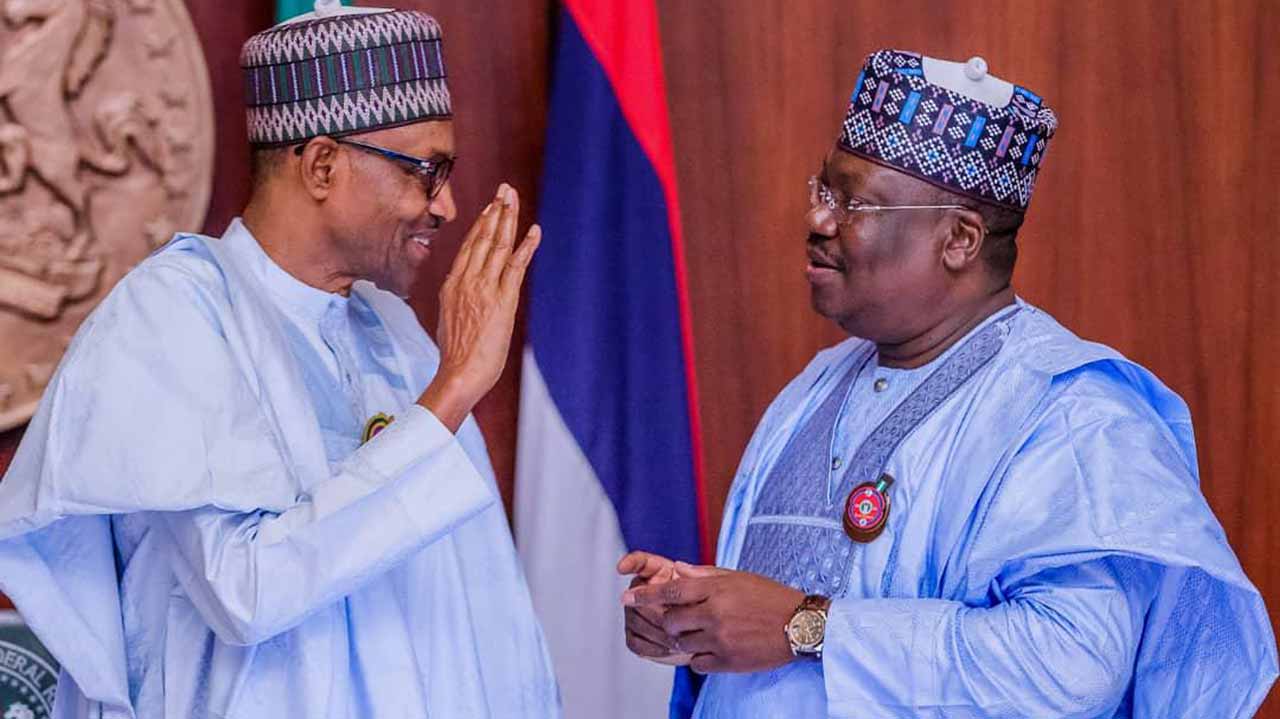

Prominent economists, Nigeria Employers’ Consultative Association and opposition parties took a swipe at the President, Major General Muhammadu Buhari, (retd.), and the Senate over the government’s N22.7tn extra-budgetary spending approved by the upper legislative chamber on Wednesday.

While groups including NECA and the Lagos Chambers of Commerce and Industry questioned the rationale for the loan by a regime that was approaching its exit, economists, in separate interviews with The PUNCH, described the approval by the Senate as unusual.

With the approval by the Senate of the N22.7tn loan from the Central Bank of Nigeria extended to the Federal Government under its Ways and Means provision, Nigeria’s external debt will rise to N68.95tn.

The Debt Management Office recently revealed that Nigeria’s total public debt stock increased to N46.25tn in the fourth quarter of 2022.

It stated that the figure consisted of the domestic and external total debt stocks of the Federal Government and the sub-national governments (36 state governments and the Federal Capital Territory).

On Wednesday, Senate approved the request of the President for Ways and Means Advances restructuring to the tune of N22.7tn, which then adds to the existing debt stock.

The Ways and Means provision allows the government to borrow from the apex bank if it needs short-term or emergency finance to fund delayed government expected cash receipts of fiscal deficits.

Since the government started experiencing a significant shortfall in revenue, it has relied heavily on the central bank to finance its expenditure programmes via Ways and Means.

The Federal Government had said it would repay the loan with securities such as treasury bills and bonds issuance.

Buhari had last year asked the Senate to approve his proposal to securitize the loan, but the Red Chamber rejected the request, citing a lack of details.

Buhari, while appealing to the Senate to reconsider its stand, said failure to grant the securitization approval would cost the government about N1.8tn in additional interest in 2023.

The Senate Leader, Ibrahim Gobir, who led the Senate in the debate for the approval of the Ways and Means on Wednesday, explained that part of the money was given as loans to states.

Gobir added that the Special Committee was set up by the Red Chamber to scrutinize the fiscal document and put up the report after critical analysis and review of submissions made by the Federal Ministry of Finance, Budget, and National Planning and the CBN.

The Senate Leader said the panel discovered that the Ways and Means balance was initially N19.33tn as of June 30, 2022, but later grew to N22.72tn as of December 19, 2022, as a result of financial obligations to ongoing capital projects and additional expenditures which includes domestic debt service gaps and interest rate.

He noted that the Senate on Wednesday, December 28, 2022, approved the sum of N819.54bn from the N1tn additional request made by the President, leaving an outstanding balance of N180.4bn being the accrued interest on the sum.

Lawmaker justifies borrowing

Gobir further stated that the House of Representatives had earlier approved the additional N1tn Ways and Means Advances requested by the President to enable the smooth implementation of the supplementary budget.

Gobir said, “Part of the Ways and Means money was given to state governments as loans to augment budgetary shortfall in their various States.

“Most of the requests for funds for an increase in Ways and Means were made to Mr President on the need to finance the budget due to revenue shortfall. Such requests were either made by the Hon. Minister of Finance, Budget and National Planning or the Central Bank Governor.

“The Federal Government as a result of revenue shortfalls occasioned by the COVID-19 pandemic and low oil prices, relied heavily on the Ways and Means to finance its budget deficit to keep the country working for the people.”

The Senate leader added, “The monies received by the Federal Government were used for funding critical projects across the country;

“That due to the serious shortfall in Government Revenue, the Federal Government for the economy not to collapse, was compelled to borrow repeatedly from the CBN, exceeding the 5 per cent threshold of the prior year’s revenue as stipulated by the CBN Act, 2007.

“That the Federal Government through the Ministry of Finance, Budget, and National Planning has concluded plans to convert the CBN loans to tradeable securities such as treasury bills and bond issuance.”

Gobir said the Senate Special Committee, after exhaustive deliberations, recommended, among others, the restructuring of N22.7tn for Ways and Means Advances be approved because the advances were made to ensure that the government does not shut down.

The panel further sought the approval of the Senate for the sum of N180.4bn, being the balance of the supplementary budget and the interest accrued on the Ways and Mean Advances.

Other recommendations were, “If there is a need to exceed the five per cent threshold of the prior year’s revenue, recourse must be made to the National Assembly for approval.

“The Federal Government through the Ministry of Finance, Budget and National Planning should expedite action on the repayment of the loans through treasury bills and bond issuances.

“The National Assembly will not condone future increase in the Ways and Means without seeking the approval of the National Assembly.”

Meanwhile, the Senate President, Ahmad Lawan, after the approval of the fiscal document, noted that the Ways and Means Advances was a global practice.

He, however, faulted the process adopted by the executive arm of government, which failed to carry the National Assembly along while accumulating a huge amount of loans.

Lawan added that the Senate had to pass the Ways and Means Advances so that the federal parliament would be able to consider and pass the 2022 Supplementary Budget still pending before the two chambers.

Lawan said, “I don’t see any National Assembly standing against any infrastructure development like the building of roads and bridges among others. It is therefore very important that before the executive incurred this kind of huge Ways and Means Advances, should, as a matter of must, seek the approval of the National Assembly. Where for, whatever reason, an emergency happened, it should not take them this kind of period before a request is sent to the National Assembly for approval.”

He added, “We have to pass these Ways and Means Advances because we don’t want the government to be shut down. The supplementary budget 2022, is on hold at the moment because we could not pass the Ways and Means request. However, with the passage of the Ways and Means Advances today, the Supplementary budget 2022, which essentially is to rehabilitate damaged roads and bridges across the country, will be fixed.”

NECA flays FG

Reacting to this, the Director General of NECA, Mr Wale Oyerinde, questioned the borrowing, which he said was dragging the economy.

He said, “Our view is this, why are we borrowing again a few days before the expiration of the current administration? What the government should focus more on now is to put a closure to most of the ongoing projects and not borrow again…