NYC gunman ID’d as Shane Tamura after deadly shooting that killed NYPD officer

Gunman Shane Tamura used Palmetto State Armory AR-15 in massacre at Midtown skyscraper

Read More

Comment

Trump tells why he fell out with Esptein

President Donald Trump has publicly revealed why he severed ties with Jeffrey Epstein, stating the disgraced financier repeatedly violated his trust.

Read More

Comment

Helmet off, Trump’s shockingly thin hair catches attention…

While donning a hard hat alongside Federal Reserve Chair Jerome Powell, Trump’s hair appeared noticeably thin after being displaced by wind, fueling ongoing speculation about his hair.

Read More

Comment

Only two things can stop Tinubu from winning in 2027 – Ali-Modu Sheriff

"I can tell you for free..."

Read More

Comment

Outrage grows over US plan to eliminate contraceptives

The Trump administration’s plan to destroy nearly $10 million worth of contraceptives has drawn sharp criticism from global health groups and lawmakers.

Read More

Comment

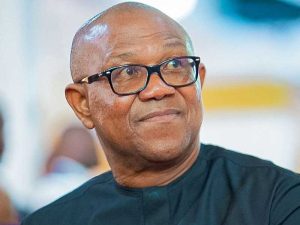

Peter Obi cannot afford to return to PDP, ADC warns

Bolaji Abdullahi, spokesperson for the African Democratic Congress (ADC), has warned that Labour Party presidential candidate, Peter Obi, cannot afford to return to the Peoples Democratic Party (PDP).

Read More

Comment

Five charged following viral Cincinnati brawl that left woman unconscious

The early Saturday incident occurred around 3 a.m. in downtown Cincinnati

Read More

Comment

Hackers breach intelligence site reportedly used by CIA

Hackers have breached the unclassified Acquisition Research Center (ARC) website used by the CIA and other intelligence agencies to handle sensitive contracts, the National Reconnaissance Office (NRO) confirmed.

Read More

Comment

Letitia James sues Trump over removal of illegal immigrants from SNAP

NY AG Letitia James announces lawsuit against President Trump

Read More

Comment

“Each ultimatum is a step towards war,” former Russian President, Medvedev, warns

Russia isn't Israel or even Iran.

Read More

Comment