Chelsea player ratings vs Ipswich: Sanchez shaky, Palmer underwhelms again

Ipswich went into the break 2-0 up after goals from Julio Enciso and Ben Johnson.

Read More

Comment

0

Corper Raye’s ₦1.2M shopping splurge stirs debate

NYSC allowee or big spender? The Raye shopping story that got Nigerians talking

Read More

Comment

0

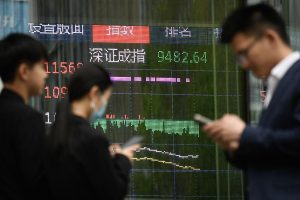

China calls on U.S. to fully lift Trump-era reciprocal tariffs

China is calling on the U.S. to “completely cancel” Trump-era tariffs, saying they harm global trade and go against bilateral agreements.

Read More

Comment

0

Secretary Rubio: Revoking visas is key to keeping America safe

Rubio says visa revocation is a vital tool to protect Americans, calling it a necessary step when credible threats emerge.

Read More

Comment

0

US court orders FBI, anti-drug agency to release investigation dossiers on Tinubu

In 1993, Bola Tinubu forfeited $460,000 to the U.S.

Now, documents confirm the FBI, DEA, and IRS believed the funds were tied to drug money laundering.

What changed in 2024? A court just ruled those records must be made public. https://t.co/aA3anB4Gux pic.twitter.com/2Wx9ckUIlc— Premium Times (@PremiumTimesng) April 13, 2025

Comment

0

Why China is unlikely to win a trade war with the U.S.

China’s steep tariffs on U.S. goods are straining its economy. Retaliatory tactics risk scaring investors, triggering inflation, and testing public patience as economic pressure mounts.

Read More

Comment

0

Beijing quietly curbs US exports despite tariff talks

U.S. exporters say China is quietly restricting American goods through unofficial barriers like customs delays and licensing slowdowns

Read More

Comment

0

Soyinka blasts Tinubu govt over Eedris Abdulkareem song ban: ‘Tell your papa’

Soyinka has criticized the Tinubu administration over the reported ban on Eedris Abdulkareem’s new song, calling it an attack on free expression.

Read More

Comment

0

U.S. Court: No evidence CIA has files on Tinubu; FBI, DEA records already released

A U.S. court says the CIA holds no records on Tinubu, with the FBI and DEA having released relevant documents.

Read More

Comment

0

Roadside bomb blast kills 8 bus passengers in northeast Nigeria

A roadside bomb in Borno State killed eight bus passengers on Friday, with authorities linking the attack to suspected insurgents.

Read More

Comment

0