DAILY POST

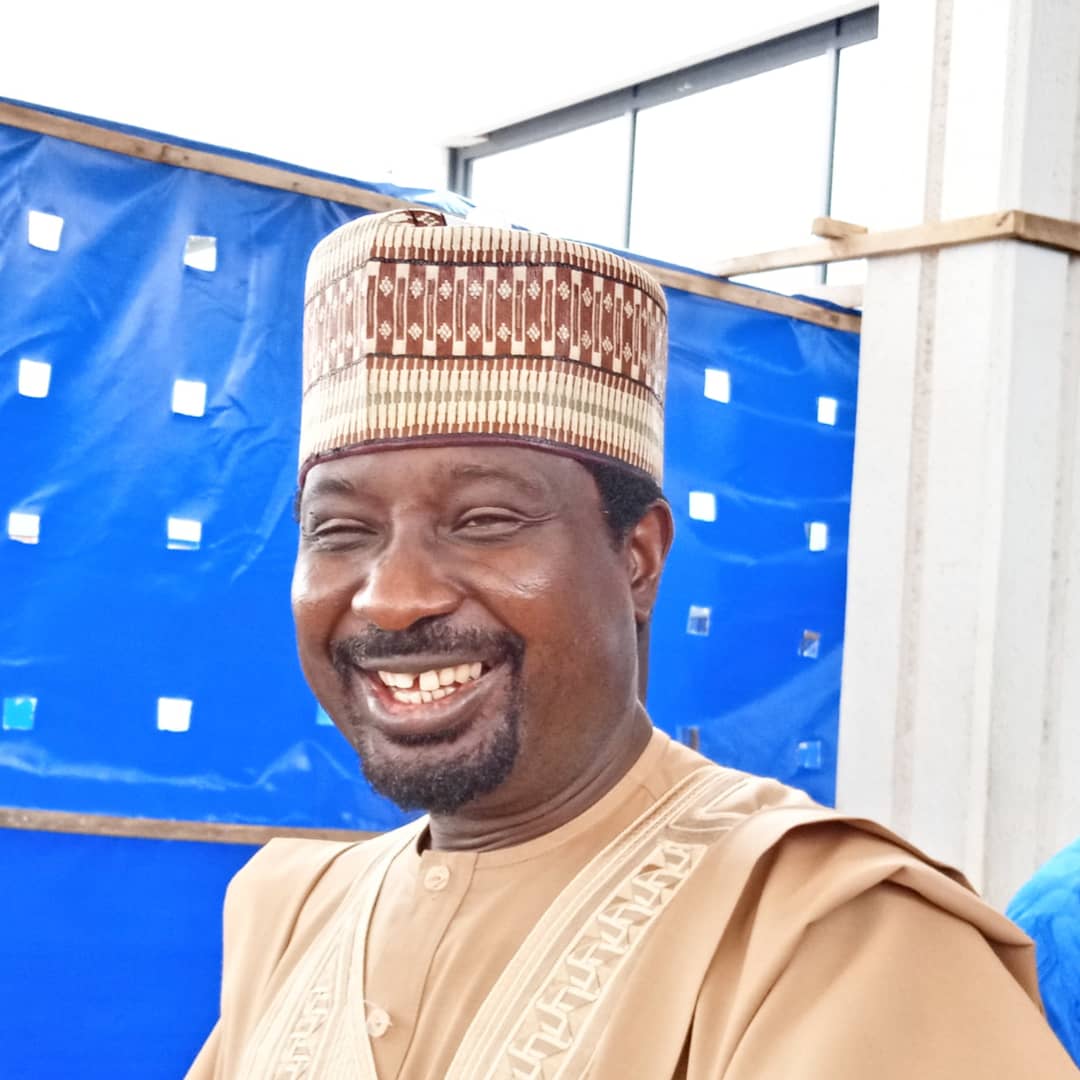

The suspended Governor of the Central Bank of Nigeria, CBN, Godwin Emefiele will no doubt remain indelible in the minds of Nigerians, perhaps for bad or good reasons.

From June 2014 to June 9th 2023, when Bola Ahmed Tinubu’s administration suspended him, Emefiele oversaw Nigeria’s monetary policies, by extension, the economy.

However, economic experts have rated Emefiele low in achieving the critical objectives of the CBN.

CBN’s primary objective is to ensure economic and price stability; issue legal tender currency in Nigeria; maintain external reserves to safeguard the international value of the legal tender currency; promote a sound financial system in Nigeria; and act as Banker and provide economic and financial advice to the Federal Government.

Rising inflation

Under Emefiele’s watch, Nigeria’s Consumer Price Index, known as the inflation rate, increased by 241 per cent, the highest compared to his predecessor Sarah Alabi who had 3 per cent during her short stay as CBN governor.

It is on record that Emefiele’s tenure has the worst inflation rate since 1999. For instance, during Joseph Sanusi’s reign from May 29th 1999, to 2004, inflation increased by 80 per cent, and Charles Suludo’s reign from May 29th 2004, to 2009, had an inflation rate of 68 per cent. Meanwhile, during the Sanusi Muhammed Sanusi regime, from June 3rd 2009 to 2014, inflation rate increased 62 per cent.

Despite consistent hikes in the Monetary Policy Rate to tackle inflation, Nigeria’s inflation continued to rise under Emefiele’s supervision. While May’s inflation figure is yet to be released, the Country’s April inflation is 22.22 per cent, and interest is 18.5 per cent.

Naira depreciation

DAILY POST reports that Multiple exchange rates were a major setback for Emefiele’s administration. Nigeria witnessed a dual exchange rate regime. The Official and black market rates are also known as the parallel markets. Based on the parallel market rate, the Naira depreciated from N167.2 in 2014 to N765 to the US dollar.

Legal Tender Management

An analysis of Nigeria’s legal tender management under Emefiele’s reign as CBN governor showed that Demand Deposits stood at N5,884,873 but increased to N20,498,1143; Credit to the Private sector increased from N16,927,983 to N44,100, 132. Meanwhile, Currency in Circulation decreased from N1,496,742 to N2,379,072.

Emefiele’s naira redesign policy which led to the scarcity of the country’s currency in the first half of 2023, has been heavily criticised for inflicting pain on Nigerians.

Capital Imported to Nigeria

From 2014 to 2016, capital imported to Nigeria dropped from $21 billion to $5 billion. Meanwhile, there was an increase from $12 billion in 20217 to $24 billion in 2019. But the imported capital dropped from $10 billion in 2020 to $5 billion in 2022.

Emefiele’s political involvement

Emefiele will go down in the annals of history as the most politically involved CBN governor.

Recall during the build-up to the primary of the All Progressives Congress, APC, Emefiele obtained a nomination form in a bid to contest the Presidential election. After falling out of favour, Emefiele returned to the apex bank.

However, his decision to mix politics with handling the country’s apex bank has been heavily criticised by Nigerians…