Strongman filmed lifting a Ford Transit van and pulled tractor with his bare hands while claiming car crash had left him unable to carry shopping bags in ‘blatantly dishonest’ insurance claim

DAILY MAIL

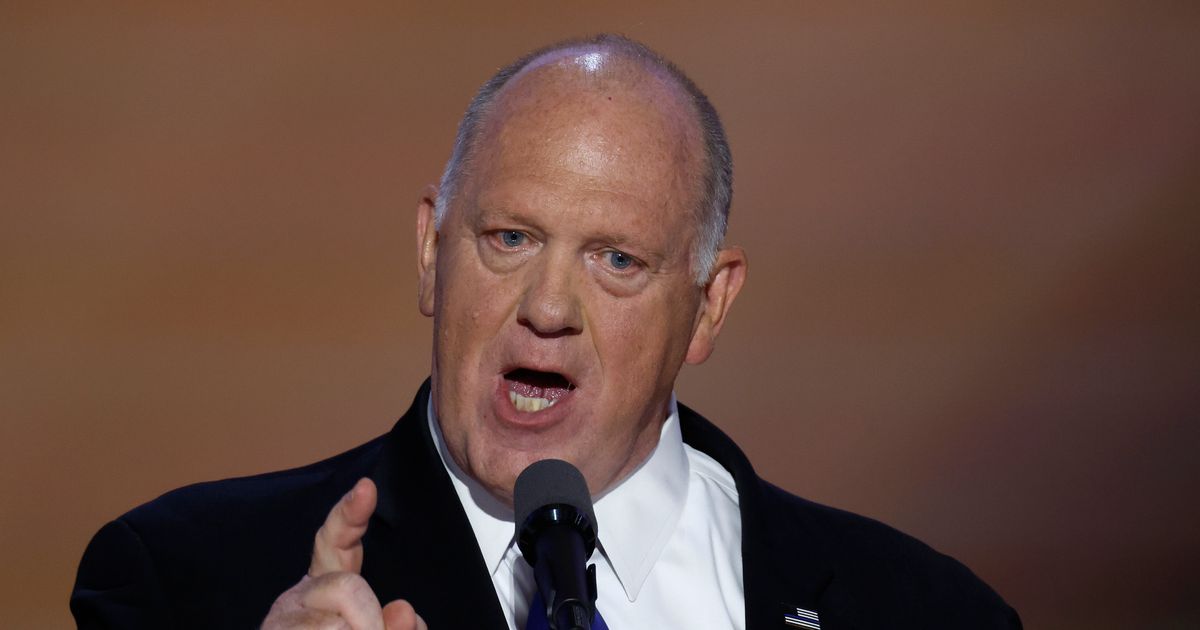

When champion strongman Scott Maw was hurt in a car crash, he told his GP he struggled carrying shopping bags.

As he claimed for a whiplash-style shoulder injury, he failed, however, to mention he was still a dab hand at lifting logs, concrete balls and even a Transit van.

The decision to seek compensation for his accident injuries, in what solicitors said was a ‘blatantly dishonest’ insurance claim against the other driver, has left him £25,000 out-of-pocket.

Two weeks after his crash in Sheffield, Maw, 36, was still able to pull an eight-tonne tractor and be crowned King of the Log Press at the Peak District Highlands Games.

And, six months later, as he said his injury problems persisted – leaving him, he claimed, ‘restricted’ in carrying shopping bags, doing DIY and ‘getting in and out of the bath’ – he bagged the title of Yorkshire’s Strongest Man.

Unsurprisingly, the extent of his injuries were disputed by the other driver’s insurance company.

Maw insists he was genuinely injured, was able to carry on competing as a strongman as his symptoms were ‘intermittent’ and he only dropped his claim because things ‘spiralled out of control’.

With his claim being contested, papers were filed with Sheffield County Court.

But eventually the strongman dropped his claim and agreed to pay the other side’s legal costs of £15,000, the total bill running to £25,000 when his own fees were added in.

The case has been made public by Markerstudy Insurance Services Limited and its lawyers HF as an example of how people who lodge ‘fundamentally dishonest’ insurance claims can pay a very heavy price.

In August 2022, Maw, a plasterer, was driving his Vauxhall Insignia car with his partner as a passenger, when a Ford T200 Connect performed an unexpected U-turn and collided with the side of his car.

There was no dispute that the other driver was to blame.

When his insurer’s lodged a claim against the other driver’s insurer, he stated that he suffered a whiplash-type problem in the form of a shoulder blade injury.

Graeme Mulvoy, the partner at HF responsible for the case, said Maw was examined by a GP in September 2022 and January 2023 when he was still claiming to be injured.

There was no visible sign of injury, such as bruising, and it was ‘all based on his account.’

Mr Mulvoy said that ‘some of the injuries described by him we say essentially couldn’t have been caused or not to the same severity be caused’ by the accident.

Connect with us on our socials: