Katy Perry and Justin Trudeau seen strolling, dining in Montreal sparking romance rumors

Katy Perry and former Canadian Prime Minister Justin Trudeau are both newly single and were spotted having dinner together in Montreal on Monday night

Read More

Comment

WATCH: Corey Booker unleashed a blistering attack on fellow Democrats…

"The Democratic Party needs a wake-up call."

Read More

Comment

Qatar, Saudi Arabia and Egypt urge Hamas to disarm and leave Gaza to end war

Qatar, Saudi Arabia, and Egypt have joined a coalition of Arab and Western nations calling on Hamas to relinquish control of Gaza and disarm as part of a renewed push for peace with Israel.

Read More

Comment

Man dies after accidentally adding detergent to tea instead of milk

An 82-year-old man with Alzheimer’s disease died after accidentally ingesting washing detergent, mistaking it for milk, an inquest has confirmed.

Read More

Comment

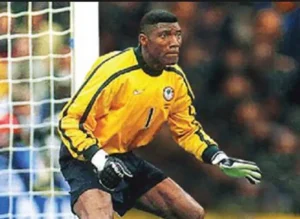

Why Peter Rufai stayed silent about his illness – Daughter

Confidence Rufai, daughter of late Super Eagles legend Peter Rufai, has explained why her father kept his illness private, saying it was in line with his love for a quiet life.

Read More

Comment

Man Utd consider move for Nick Pope if Newcastle sign Aaron Ramsdale

Manchester United are reportedly weighing a transfer move for Nick Pope should Newcastle United sign Aaron Ramsdale from Southampton.

Read More

Comment

Ramsdale set to join Newcastle on loan from Southampton

Newcastle United have reached an agreement with Southampton to sign England goalkeeper Aaron Ramsdale on loan, with an option to buy.

Read More

Comment

Trump claims Epstein “stole” Virginia Giuffre from Mar-a-Lago…

Trump speaks out on Epstein and Giuffre

Read More

Comment

Trump threatens new bombing if Iran resumes uranium enrichment

President Donald Trump has warned that the United States would bomb Iran again if it restarts uranium enrichment at its previously targeted nuclear sites.

Read More

Comment

Netanyahu slams Starmer for supporting Palestinian statehood recognition

He says Starmer's decision "rewards Hamas's monstrous terrorism..."

Read More

Comment