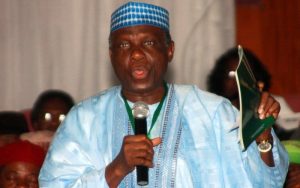

PDP remains strong, has no plans to join any coalition – Former Obasanjo Minister

A former minister under ex-President Olusegun Obasanjo has reiterated that the People's Democratic Party (PDP) is solid and has no intentions of joining any political coalition.

Read More

Comment

0

Saudi Arabia reportedly set to settle Syria’s World Bank debts, sources claim

Saudi Arabia is reportedly planning to pay off Syria's outstanding debts to the World Bank, sources reveal, in a move that could significantly improve Syria's financial standing.

Read More

Comment

0

Southern California rattled by widespread earthquake tremors

A 4.8-magnitude earthquake struck near San Diego on Monday, sending tremors across Southern California and prompting swift emergency responses.

Read More

Comment

0

Rare earth minerals are actually commonplace—but China’s refining grip keeps U.S. reliant

Rare earths are not rare. They're in fact quite common. The ones that we use the most are as common as copper or lead, and in fact you can find them on every continent, and on the ocean floor, and they're also in our technologies around us.

Read More

Comment

0

China cuts off rare earth magnets – and US factories are sweating

China has abruptly stopped exporting rare earth magnets to the United States following new tariffs imposed by former President Donald Trump, sparking concerns across key U.S. industries.

Read More

Comment

0

Trump’s latest deportation plan: Open to deporting US citizens who commit violent crimes

Donald Trump has suggested sending US citizens convicted of crimes to El Salvador, in a controversial proposal aimed at addressing crime and immigration issues.

Read More

Comment

0

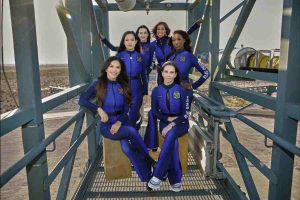

Blue Origin launches all-female celebrity space crew with Katy Perry, Gayle King, and Lauren Sanchez

Blue Origin successfully launched an all-female celebrity space crew, including Katy Perry, Gayle King, and Lauren Sanchez, on a suborbital mission.

Read More

Comment

0

Tesla leads U.S. EV market in Q1 2025 with Model Y, Model 3

Tesla topped U.S. EV sales in Q1 2025, with the Model Y and Model 3 leading at over 64,000 and 52,000 units. Model 3 sales jumped 70% year-over-year.

Read More

Comment

0

Party sues Tinubu, others for N20bn over Rivers emergency rule plot

ADC files N20bn lawsuit against President Tinubu and others over alleged emergency rule plans in Rivers State.

Read More

Comment

0

Scientists confirm eerie “milky seas” glow visible from space

Scientists confirm glowing “milky seas” are real, caused by bioluminescent bacteria and large enough to be seen from space.

Read More

Comment

0