CBS NEWS

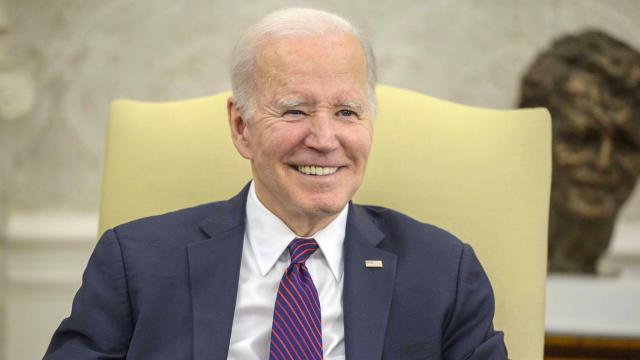

As President Joe Biden and congressional leaders are in a high-stakes standoff over the debt limit, experts warn it would be catastrophic if leaders do not reach an agreement in time – and launch the economy into chaos. If Congress does not raise or suspend the debt limit, the Treasury Department estimates the United States could run out of money as early as June 1, giving a divided Congress just weeks to reach a deal.

“This would be a huge hit to the economy and really an economic catastrophe,” Treasury Secretary Janet Yellen told CNBC on Monday. She has warned that there is no action Mr. Biden and the Treasury can take to prevent disaster if Congress does not act.

“If Congress doesn’t raise the debt ceiling, the president will have to make some decisions about what to do with the resources we do have, and there are a variety of different options, but there are no good options. Every option is a bad option,” said Yellen. “The only option that really leaves our economy in good shape is — and our financial system — is raising the debt ceiling.”

Amid escalating rhetoric and little progress, Federal Reserve Chairman Jerome Powell has also said Americans cannot rely on the central bank to protect them from the fallout if the U.S. defaults for the first time.

“We shouldn’t even be talking about a world in which the U.S. doesn’t pay its bills. It just shouldn’t be a thing,” Powell said. “No one should assume that the Fed can… really protect the economy and the financial system, and our reputation globally, from the damage such an event might inflict.”

If the U.S. hits the X-date without lawmakers reaching an agreement, it would be uncharted territory.

“If we hit June 1, that means the Treasury will have a difficult time predicting on a daily basis if that day’s tax revenues will be enough to cover that day’s spending obligations,” said Brian Riedl, senior fellow at think tank The Manhattan Institute.

What would the government not paying its bills mean for the economy?

There would be volatility in markets – with a lot of people seeing red. From the stock market to the bond market and the foreign exchange, markets would be roiled by the U.S. not paying even the more insignificant bills.

“The first thing that will happen is people’s 401K plans will be worth less,” said Mark Zandi, chief economist for Moody’s Analytics. “Their wealth will be diminished by what’s going on in the markets because investors are going to be discounting the possibility that lawmakers don’t get together and the economy goes into recession and there will be a default on the debt.”

The cost of borrowing would also go up, and the availability of credit would be lower – making it more expensive and challenging to get a personal loan, car loan or mortgage. The longer it goes on, the uglier the economic downtown would likely be, experts say.

“We could see anything from military pay, veteran benefits, Medicare provider payments, numerous other payments that would come due immediately or in the following days, some of which would be made on time or not,” said Rachel Snyderman of the Bipartisan Policy Center.

The Bipartisan Policy Center estimates the U.S. could hit the X-date happen within weeks as tax receipts have been below expectations…